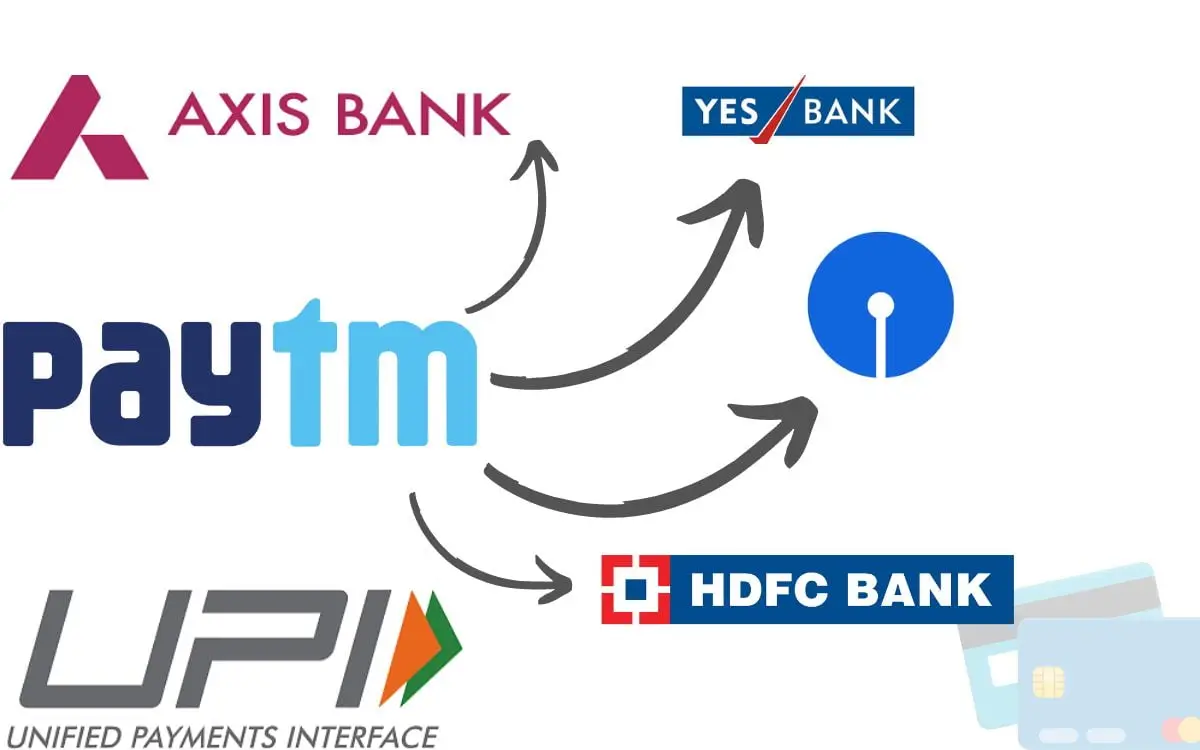

Paytm one of India’s popular digital payment company, received approval from the National Payments Corporation of India (NPCI) to retain its UPI transactions with the help of four major banks. State Bank of India (SBI), Axis Bank, HDFC Bank, and YES Bank, one government and three private bank are going to help paytm today onwards.

Paytm users are relieved by this decision, particularly in light of recent regulatory changes. Paytm Payments Bank Ltd (PPBL) was prohibited by the Reserve Bank of India from engaging in any specific financial operations from 15 march 2024, such as receiving deposits, credit transactions, fast tag or top-ups of client accounts and fixed deposits, until March 15. One97 Communications Limited (OCL), the company that owns the Paytm and paytm payment bank and has a 49% ownership in PPBL, is the parent company of PPBL.

Paytm wants to assure its users ongoing service by making partnerships with these prominent banks. These partnerships show Paytm’s commitment towards customer happiness and emphasise the value of flexibility in the swiftly evolving fintech industry.

Collaborations between fintech businesses and traditional financial institutions grow more and more essential as the digital payment ecosystem continues to change. Paytm’s tenacity and resolve to stay at the forefront of India’s digital payment revolution are demonstrated by its ability to negotiate regulatory obstacles and form alliances.

- Play YouTube in background free Android – Try These Free Alternatives in 2026

- How to Delete Pinterest Account in easy steps

- How to Delete Your JioCinema Account: A Simple Guide

- How to Delete Binance Account: A Complete Step-by-Step Guide

- How to Delete Your Snapdeal Account: Step-by-Step Guide & Top Alternatives

In conclusion, Paytm’s commitment to offering dependable and easy-to-use payment solutions to millions of consumers nationwide is demonstrated by its ongoing UPI operations through strategic bank partnerships. This move clarifies that Paytm’s standing as a major participant in India’s digital payment ecosystem.